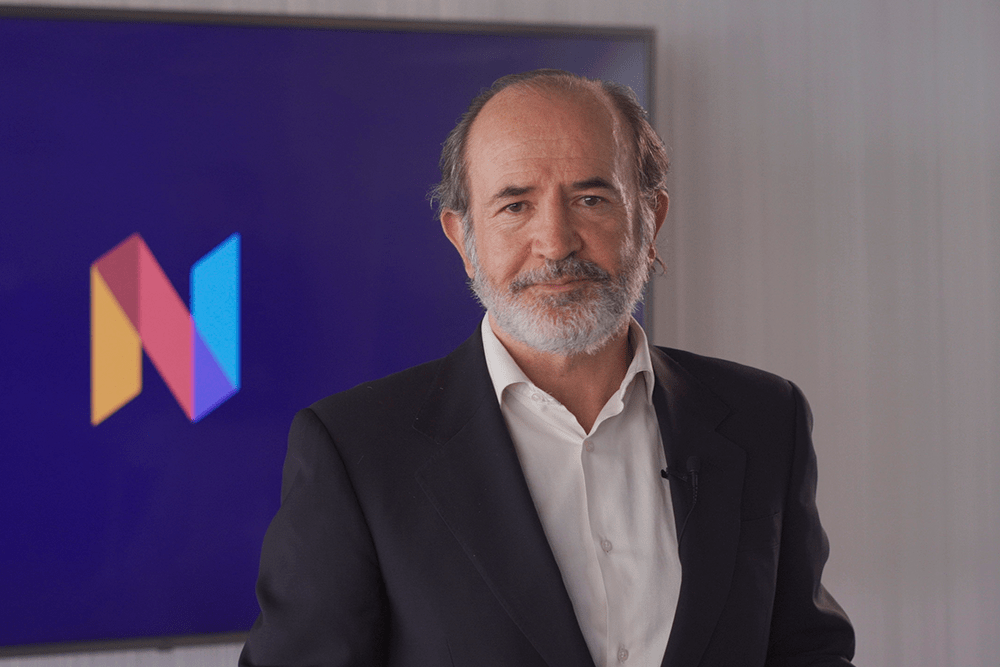

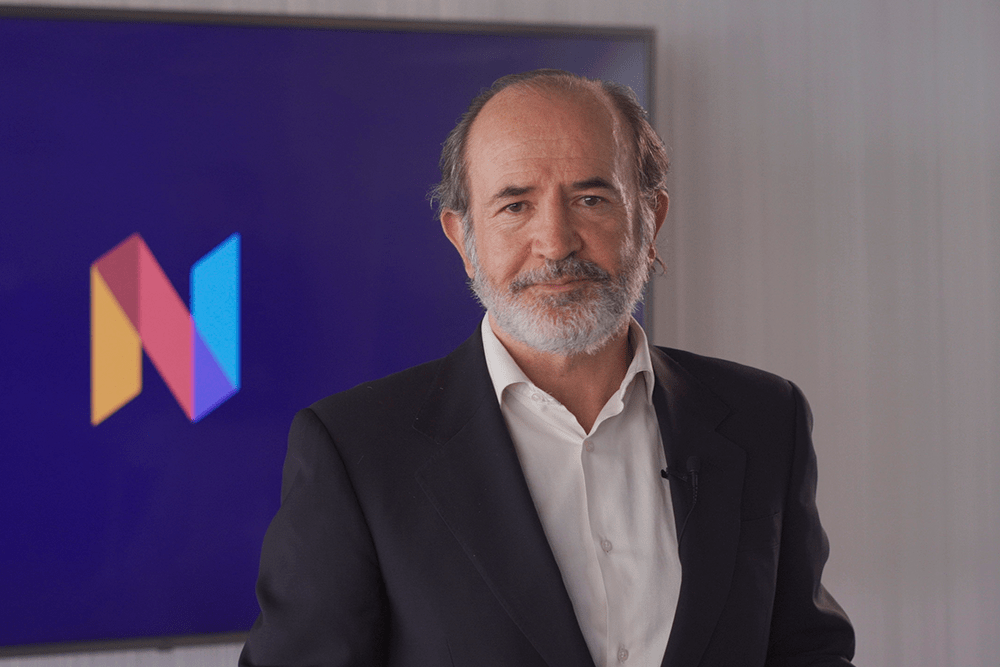

Tomás Conde, one of the most prominent professionals in our country in Sustainable Finance joins...

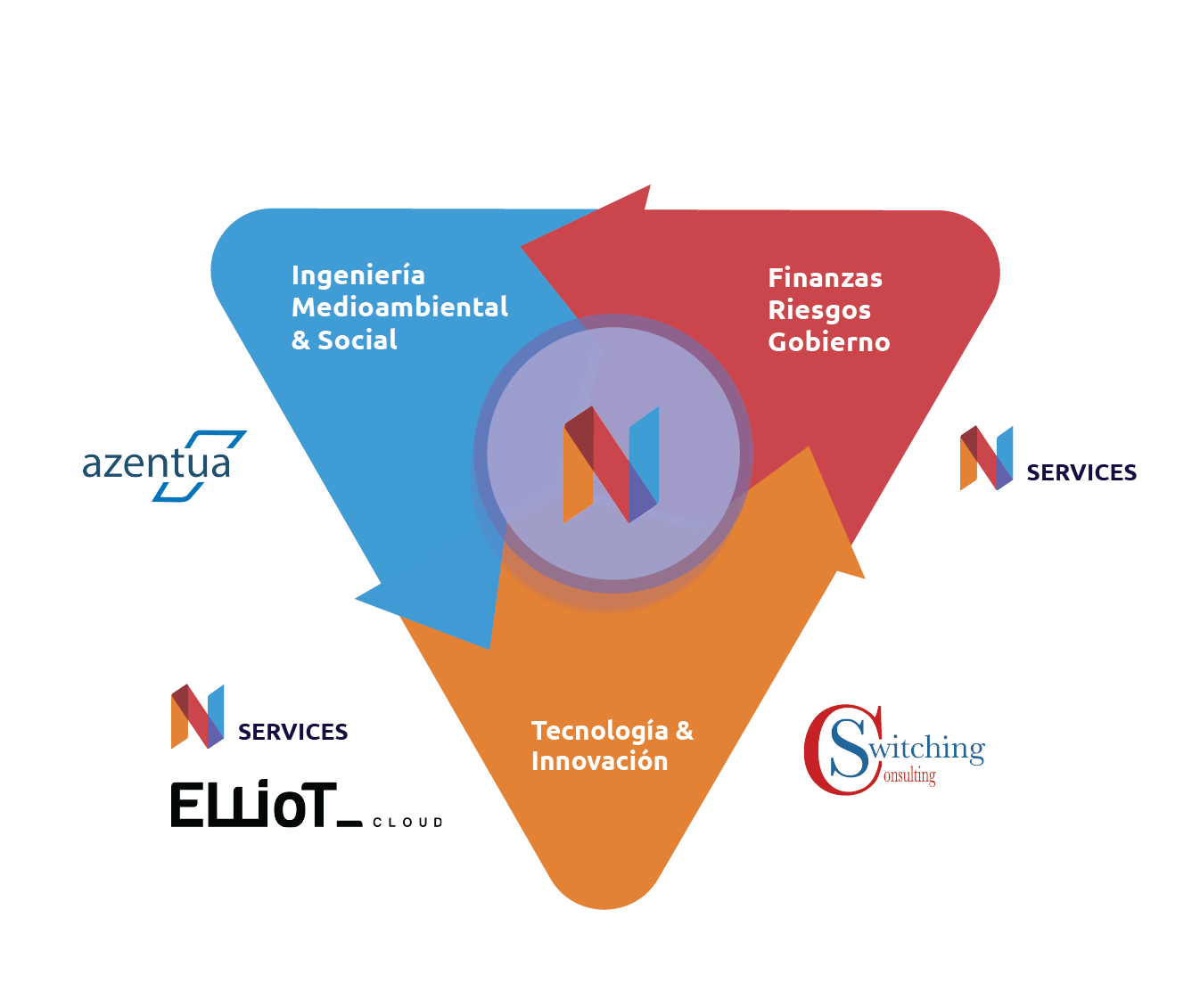

Business

05/11/21

Sustainable Finances & ESG