Analysis of legal requirements that apply to the company in terms of Financial Taxonomy.

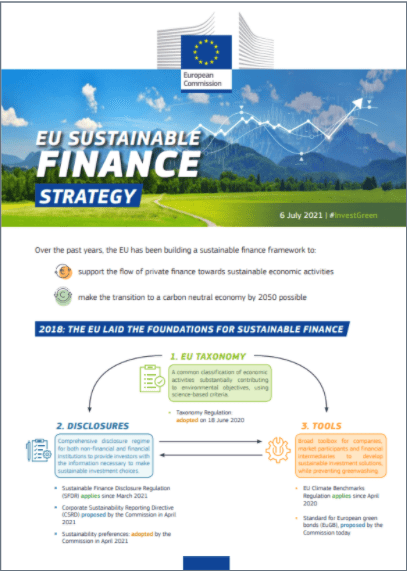

Taxonomy helps drive climate-friendly investments and allows investors to invest their money according to their sustainability priorities.

Want to know more about Taxonomy?

Download our guide on European financial taxonomy for companies

Contact

Alignment of activities of an automotive parts manufacturing company with the European Taxonomy on Sustainable Finance, with the EU Regulation 2020/852 of the European Parliament and of the Council, as well as with its delegated acts.

Taxonomy helps drive climate-friendly investments and allows investors to invest their money according to their sustainability priorities.

Results

We provide the company with a complete adaptation to the European regulatory framework in terms of sustainability, covering the critical points of its activity.

- Analysis of legal requirements that apply to the company in terms of Financial Taxonomy.

- Categorisation of the company's assets according to whether they belong to activities with direct significant contribution, enablers of other activities with significant contribution, or ineligible activities.

- Calculation of indicators (turnover, OPEX and CAPEX) of the activities and development of a report showing the alignment to the Taxonomy.

- Development of a methodological guide for companies, recommendations and future trends.